Welcome, fellow taxpayers! If you’ve ever been curious about the infamous W-2 Form or find yourself in need of the W2 Form PDF, you’ve come to the right place. In this informative yet engaging guide, we’ll unravel the mysteries of the W-2 Form, explore who needs to file it, and walk you through the process of obtaining your very own W2 Form.

Table of Contents

ToggleWhat Is Form W-2 (Wage and Tax Statement)?

Think of the W-2 Form as your annual financial report card. It’s a document that your employer provides, summarizing your earnings, taxes withheld, and other essential financial information. The W-2 Form is crucial for both you and the IRS to ensure accurate tax filing.

Who Needs to File W2 Form?

The answer is relatively straightforward: anyone who has received income as an employee in the United States. Whether you’re a full-time worker, part-time employee, or seasonal staff member, if you received compensation, your employer is obligated to provide you with a W-2 Form.

Additionally, businesses and organizations that employ individuals must also file W-2 Forms with the IRS. It’s a vital part of the tax system, ensuring that everyone’s income and taxes align correctly.

How to Get Your Form W-2? A Quick Guide

Now, let’s address the crux of your interest: how to obtain your W2 Form PDF.

- Wait for It: Your employer is legally obligated to furnish your W-2 Form by January 31st of each year. So, keep an eye on your mailbox or email inbox during tax season.

- Access Your Employer’s Portal: Many employers provide access to W-2 Forms through their online HR portals. Log in, find the W-2 section, and you might be able to download the W2 Form PDF directly.

- Request a Copy: If you haven’t received your W-2 Form by mid-February, reach out to your employer’s HR or payroll department. They can either send you a copy or provide guidance on where to obtain it.

- Use Tax Software: If all else fails, tax preparation software can be your savior. Many popular tax software options allow you to import your W2 Form PDF directly into your tax return.

- IRS Assistance: In extreme cases, if you still can’t obtain your W-2 Form, you can contact the IRS. They’ll reach out to your employer on your behalf to ensure compliance.

A Quick Guide to Read Form W-2

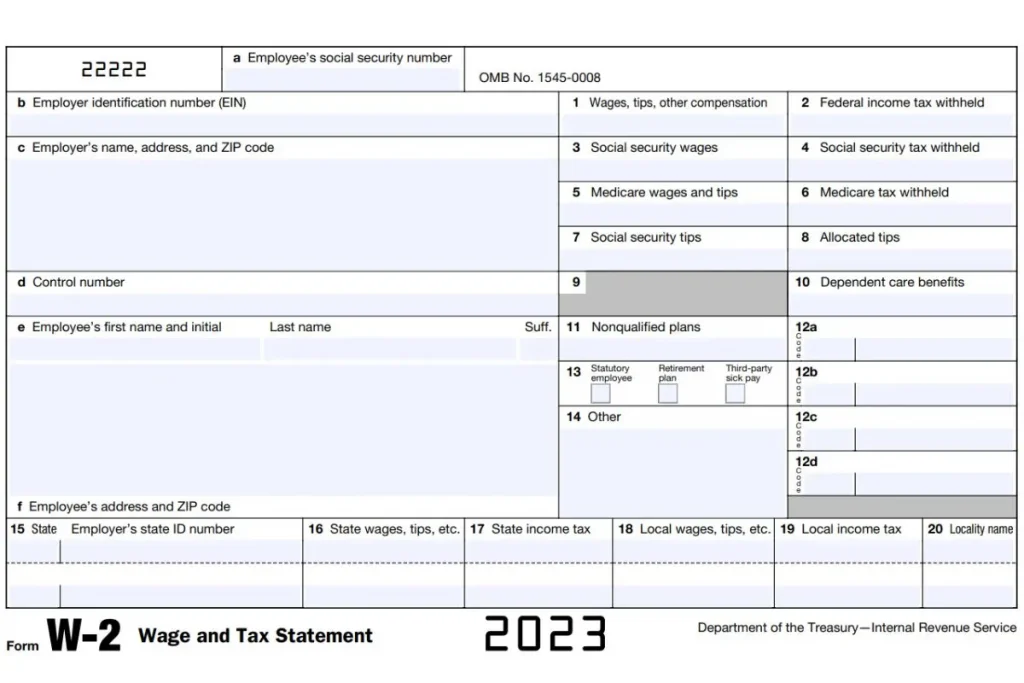

The W-2 Form might seem like a labyrinth of codes and numbers, but fear not! It’s not as complicated as it appears. Here’s a quick overview:

- Box 1: Your total taxable wages.

- Box 2: Federal income tax withheld.

- Box 3: Your Social Security wages.

- Box 4: Social Security tax withheld.

- Box 5: Your Medicare wages.

- Box 6: Medicare tax withheld.

- Box 16: State wages, if applicable.

These boxes are essential for accurately filing your tax return, so ensure you review them carefully.

In Conclusion

The W-2 Form is a crucial piece of the tax puzzle, and now, you’re well-equipped to understand it better and obtain your W2 Form PDF effortlessly. Remember, this document holds the key to a smooth tax filing process, so make sure you have it in your possession when tax season arrives.

So, whether you’re a seasoned taxpayer or just starting your tax journey, don’t let the W-2 Form mystify you any longer. Download W2 Form PDF, review it thoroughly, and embark on your tax-filing adventure with confidence!